seattle payroll tax calculator

So a lot can still. The City of Seattle Washington will impose a new employer-only Payroll Expense Tax effective 1 January 2021The filing of this tax was optional until Q4 2021and Zenefits is.

7 Considerations Before Choosing Payroll Software For Your Business Payroll Software Payroll Big Business

The payroll expense tax also known as JumpStart Seattle City Ordinance 126108.

. Rates also change on a yearly basis ranging from 03 to 60 in 2022. Taxes Paid Filed - 100 Guarantee. Find 10 Best Payroll Calculator Tools.

The Washington Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Washington. After a few seconds you will be provided with a full breakdown. This page aggregates the highly-rated recommendations for Seattle Paycheck Calculator.

Get the Payroll That Fits Your Business With Us. Use the paycheck calculator to figure out how much to put. Find Free Unbiased Reviews Today.

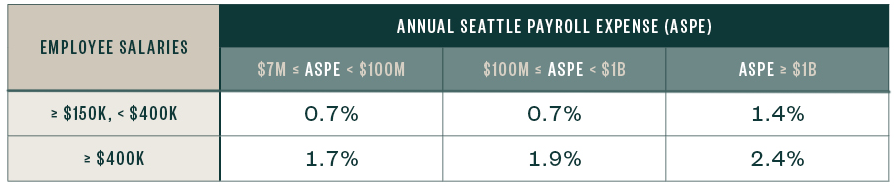

To use our Washington Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. The tax rate ranges between 7 and 24 and is based on both the annual compensation paid to each employee and the total Seattle payroll expense of the business. Discover ADP For Payroll Benefits Time Talent HR More.

Ad Intuit QuickBooks Automatically Calculates Federal and State Payroll Taxes. Manage Garnishments and Deductions. Get the Payroll That Fits Your Business With Us.

They are the choices that get trusted and positively-reviewed by users. Ad Process Payroll Faster Easier With ADP Payroll. Move forward to July 2020 and the Seattle City Council passes another form of payroll tax.

If you contribute more money to accounts. The Seattle payroll tax payments are not actually due until January 31 2022 and the Seattle Metropolitan Chamber of Commerce is suing to block the tax. Ad Compare 10 Best Payroll Calculator Tools.

Ad Intuit QuickBooks Automatically Calculates Federal and State Payroll Taxes. Discover ADP For Payroll Benefits Time Talent HR More. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Washington is one of several states without a personal income tax but that doesnt mean that the Evergreen State is a tax haven. 2021 Social Security Payroll Tax Employee Portion Medicare Withholding 2021 Employee Portion To contact the Seattle Department of Revenue please. For 2022 the wage base is 62500.

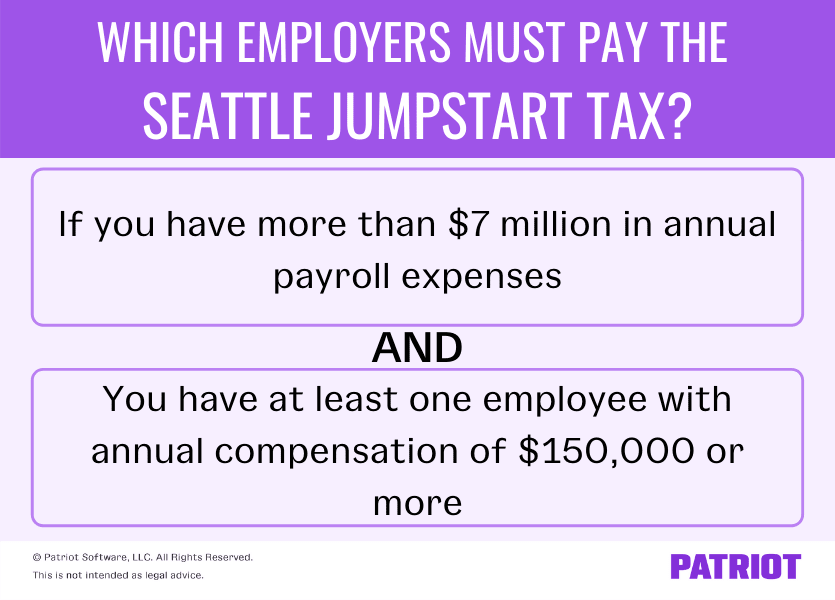

It is not a substitute for the. The payroll tax also called JumpStart tax was passed by Seattle City Council in June 2020 and went into effect on January 1 2021. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Washington State Unemployment Insurance varies each year. Manage Garnishments and Deductions. Get Started With ADP.

The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Washington residents only. Washington Hourly Paycheck Calculator. Although the tax has been in effect for the.

The Seattle payroll tax is measured by the payroll expense of the business times a rate that varies based on the businesss total Seattle payroll expenses and the compensation. Ad Process Payroll Faster Easier With ADP Payroll. Washington Salary Paycheck Calculator.

Salary paycheck calculator guide. While taxpayers in Washington dodge income taxes they pay. Another thing you can do is put more of your salary in accounts like a 401 k HSA or FSA.

Get Started With ADP. Responsive Easy-to-Use Try Now. Calculate your Washington net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state.

Although our salary paycheck calculator does much of the heavy lifting it may be helpful to take a closer look at a few of the calculations that are.

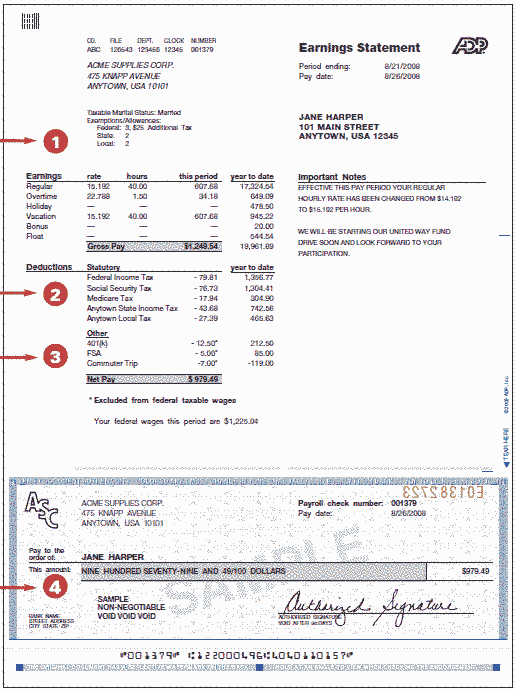

Sample Pay Check And Fica Taxes Savings For Cpt Opt Studetns

Understanding Payroll Taxes And Who Pays Them Smartasset

Seattle Payroll Expense Excise Tax Details

The Seattle Payroll Expense Tax What You Need To Know Clark Nuber Ps

Blog Akopyan Company Cpa Seattle Accounting Firm Taxes Payroll Payroll Accounting Firms Cpa Marketing

Free Weekly Payroll Tax Worksheet Payroll Taxes Payroll Template Payroll

New Seattle Jumpstart Tax Overview Rates More

Seattle S Payroll Expense Tax On Salaries Of Top Earners Bader Martin

6 Best Online Payroll Calculators In 2019 Business Icons Vector Business Icon Payroll

Sap Hcm Us Payroll Tax Calculation Illustration Sap Blogs

Blog Akopyan Company Cpa Seattle Accounting Firm Taxes Payroll Accounting Firms Business Tax Payroll

Payroll Templates Employee Payroll Payroll Template Payroll Blog Website Inspiration

Understanding Payroll Taxes And Who Pays Them Smartasset

Sap Hcm Us Payroll Tax Calculation Illustration Sap Blogs

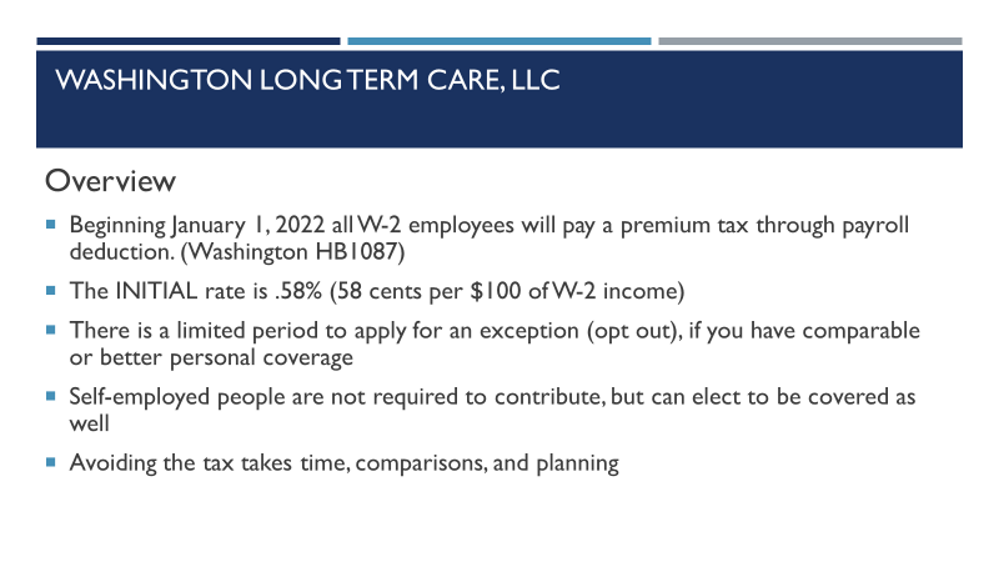

Payroll Washington Long Term Care Llc

Gtm Payroll Services Great Calculator Nanny Tax Payroll Domestic Worker

Seattle S Payroll Expense Tax On Salaries Of Top Earners Bader Martin

The Small Business Beginner S Guide To Payroll Small Biz Dailysmall Biz Daily Payroll Payroll Software Corporate Law